What is AI Price Monitoring & How Can Price Benchmarking Benefit You?

Competitor price monitoring and benchmarking are more crucial to retailers now than ever. Estimates put the number of e-commerce businesses anywhere between a staggering 12 to 24 million sites. With such crowded markets and continuously accelerating consumer preferences and trends, the margin for error in pricing is far less forgiving than it once was, especially as consumers can easily scour competing collections at the click of a button!

Today, the successful retailers are those who leverage leading edge technology and AI tools like Centric Market Intelligence™ to make the most informed and efficient pricing decisions based on accurate and real-time data.

What is Competitive Price Monitoring and Price Benchmarking?

Competitor price monitoring or competitor price tracking, as it’s also called, is a long-term process of analyzing key competitors’ pricing continuously in order to develop an overall picture of pricing patterns. Over time, this allows planning teams to more accurately predict and anticipate changes. By collecting and compiling daily data with the help of a price monitoring tool, you can not only gain a historic macro view of competitor pricing but be alerted to changes such as discounting, which can allow for swifter changes to your own pricing strategy.

While competitor price tracking demands long-term commitment which takes in multiple variables over a large swath of the market, price benchmarking is more fine-tuned. It complements monitoring by comparing pricing against a specific set of competitors and analyzes specific data points such as season change or holiday sales. The combination of retail price monitoring and benchmarking provides a double-shot of insight from both a macro and granular view.

What’s the Importance of Price Monitoring and Benchmarking?

Retail shopping is not what it was when price monitoring strategies were first developed. Previously, a shopper would need to physically travel to another store to compare a price, an arduous and potentially fruitless use of their time. But in today’s e-commerce environment, comparative shopping simply requires the click of a mouse or the scroll of a screen. Today, price browsing is nearly instantaneous, which makes it all the more important to remain competitive and in sync with the pricing fluctuations within a market.

A wrong price, poorly timed discount, or collection misstep can lead to a ripple effect of negative outcomes such as excess inventory and lost revenue. Simply looking at internal data is nowhere near as valuable as internal data within the context of accurate external information. Take international fashion retailer Lindex, who, with Centric Market Intelligence, was able to identify a past gap in their kidswear pricing assortments. Thanks to this new information, the team was able to identify how competitors were behaving differently and make adjustments based on this data.

Key Features of Competitor Price Monitoring and Benchmarking Software

With many pricing monitoring software tools available, it can be challenging to sift through options and find the right one. Lindex’s selection team, made up of a designer, buyer, and design and buying manager, investigated multiple software candidates before determining that Centric Market Intelligence was the best, most comprehensive choice for their needs based on its AI-driven analytics and product matching solution.

When doing your own research and choosing an ecommerce price monitoring software, you want to ensure that the tool offers a number of different analytic features, including:

- The ability to look at both historical data and real-time charts of information

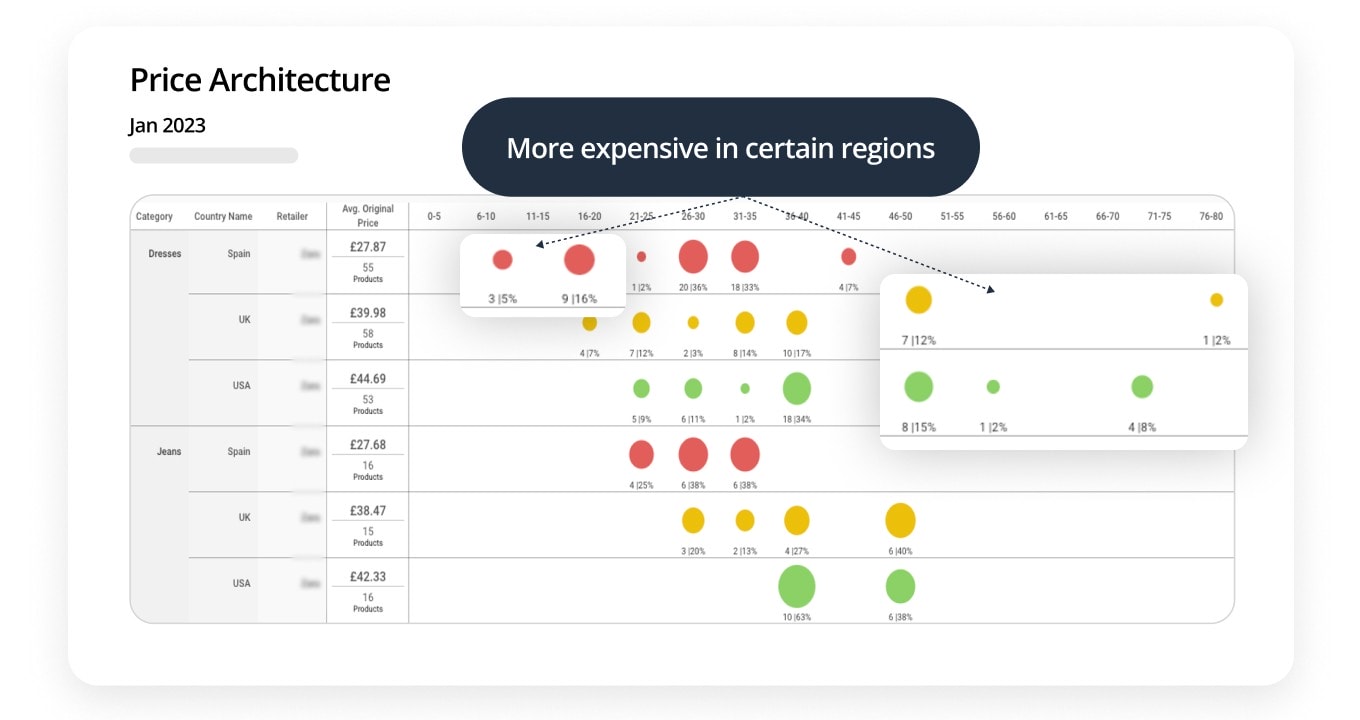

- Examination of pricing architecture, which includes global access to see how a brand sets pricing across geographies

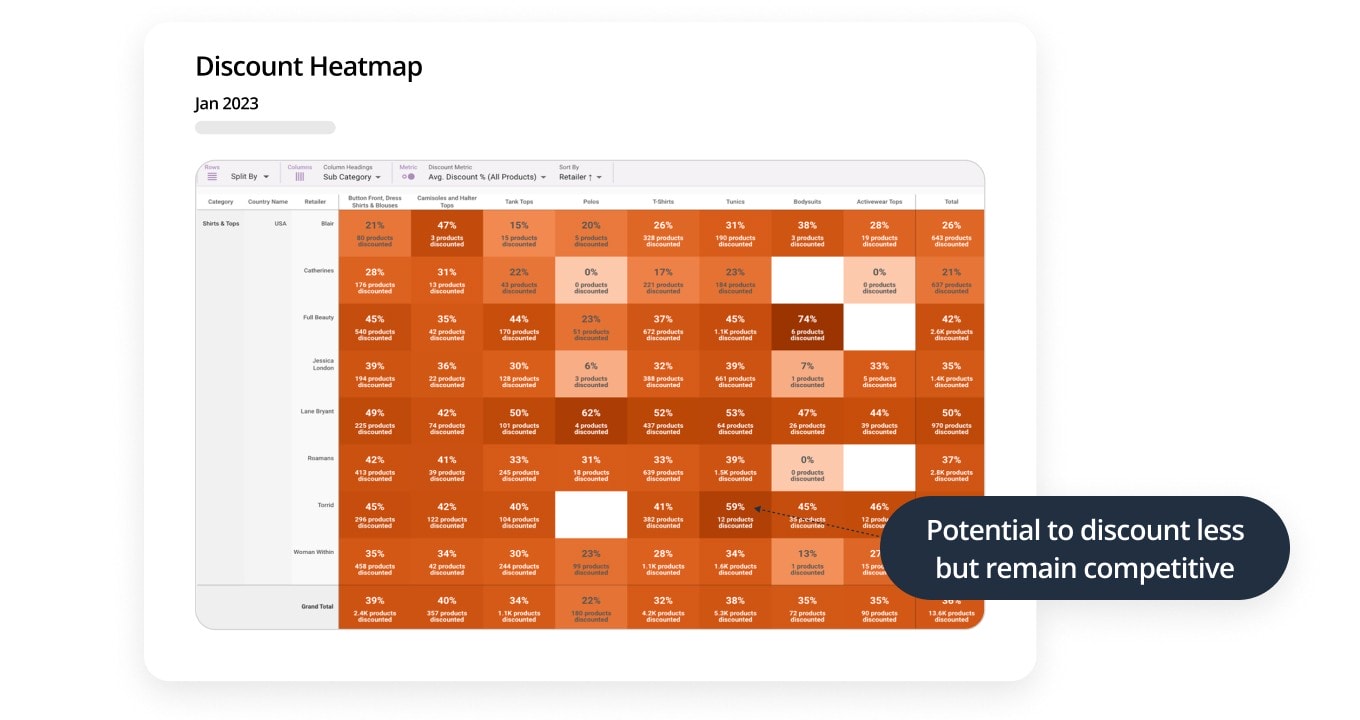

- Insights in competitor discounting and analysis of competitor assortments

Are you still attempting to manually track competitor pricing and assortment data? Many companies are still stifled by this labor-intensive, time-consuming process which can overlook key pricing information. Boardriders, the leading action sports and lifestyle company behind popular brands such as Quicksilver, Billabong, and ROXY struggled with manual competitor price tracking for years, experiencing less than complete results and scattered data.

This caused a disconnect in data which failed to provide quantitative analysis of the information compiled. Tired of this ineffective, scattered approach which caused skewed data results and decision-making based on insufficient data, the company made the switch to Centric Market Intelligence to streamline the process of price tracking with more accurate information.

A good competitor pricing and price monitoring software that provides high quality, accurate data can allow for category standardization. This can only be accomplished when a solution, like Centric Market Intelligence, has attributes and taxonomy are so rich that products can be correctly categorized into like for like. For instance, your company needs to compare dresses and rompers separately. But if a system thinks they are both the same type of product, this leads to double counting where your resulting data will be skewed and inaccurate.

Look for a retail price monitoring software that has this rich taxonomy, the ability to select very granular attributes like lace dress, 3/4 short sleeve tops, blouses just with gold buttons, or jeans that are a certain length or fit, allows you to be very specific in finding similar products to compare. These small details matter.

Understanding the how, why and when of competitor pricing and discounting provides the insight you need to make better, more informed decisions. Pricing intelligence shows you where gaps exist, whether an assortment or pricing opportunity. E-commerce price monitoring is especially important for multi-brand retailers who carry exactly the same products as competitors and need to remain consistent with their pricing. Find out more about product matching for multi-brand retailers.

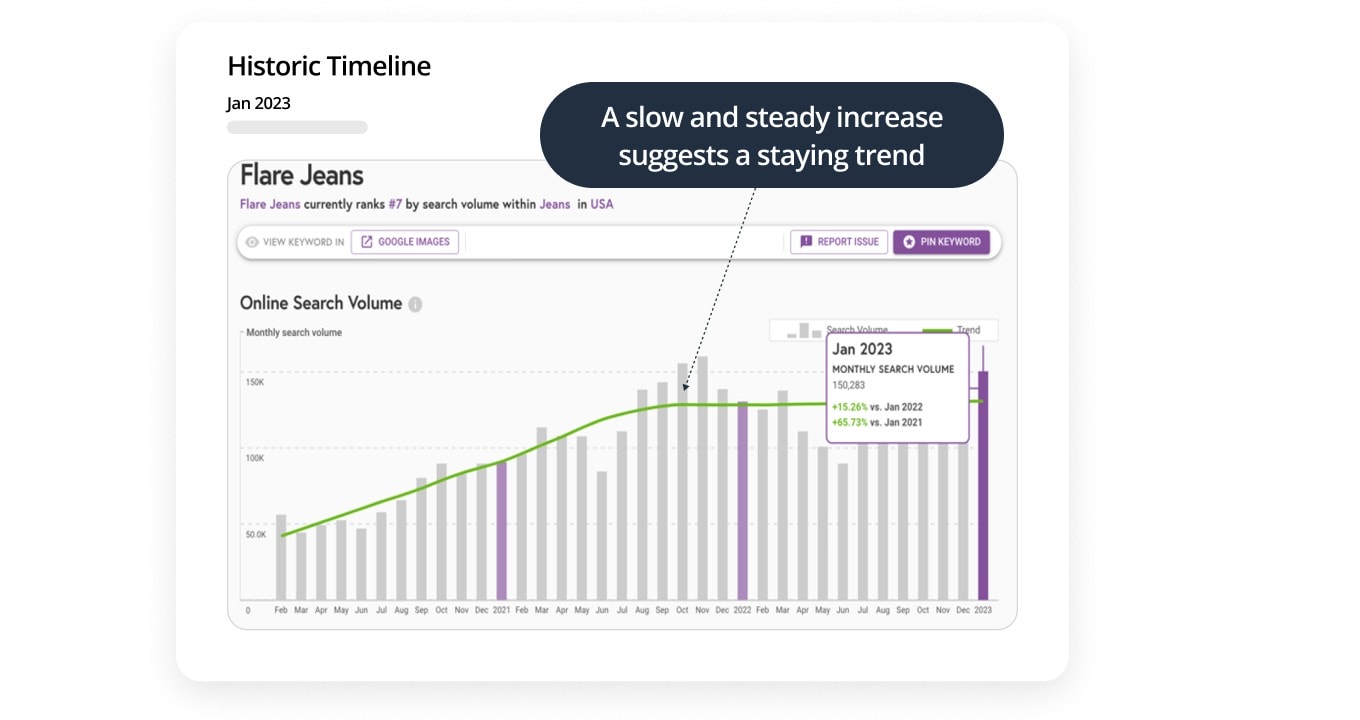

Consumer tastes change quickly. Trends have a continuously shrinking window of opportunity. A competitor pricing tool, like Centric Market Intelligence kinds of colors and trends they’re investing in. This can help merchandisers and planners develop assortments that consumers want and avoid missteps that can severely impact revenue.

Boardriders, for instance, has effectively utilized this data to improve their ROI based on the information they glean from using Centric Market Intelligence. Hendrik Kriel, Global Director, Data Insights and Reporting at Boardriders says:

What Centric Market Intelligence has been for us is a visual guide to what other retailers are doing. That’s been very helpful, because a lot of my world used to be Excel-based. We were in a meeting a couple of weeks ago, and wondered, what is Competitor X doing? And within seconds, we had a quick gauge of what they do, versus having to get interns to sit there for days, extracting 10% of what you need.

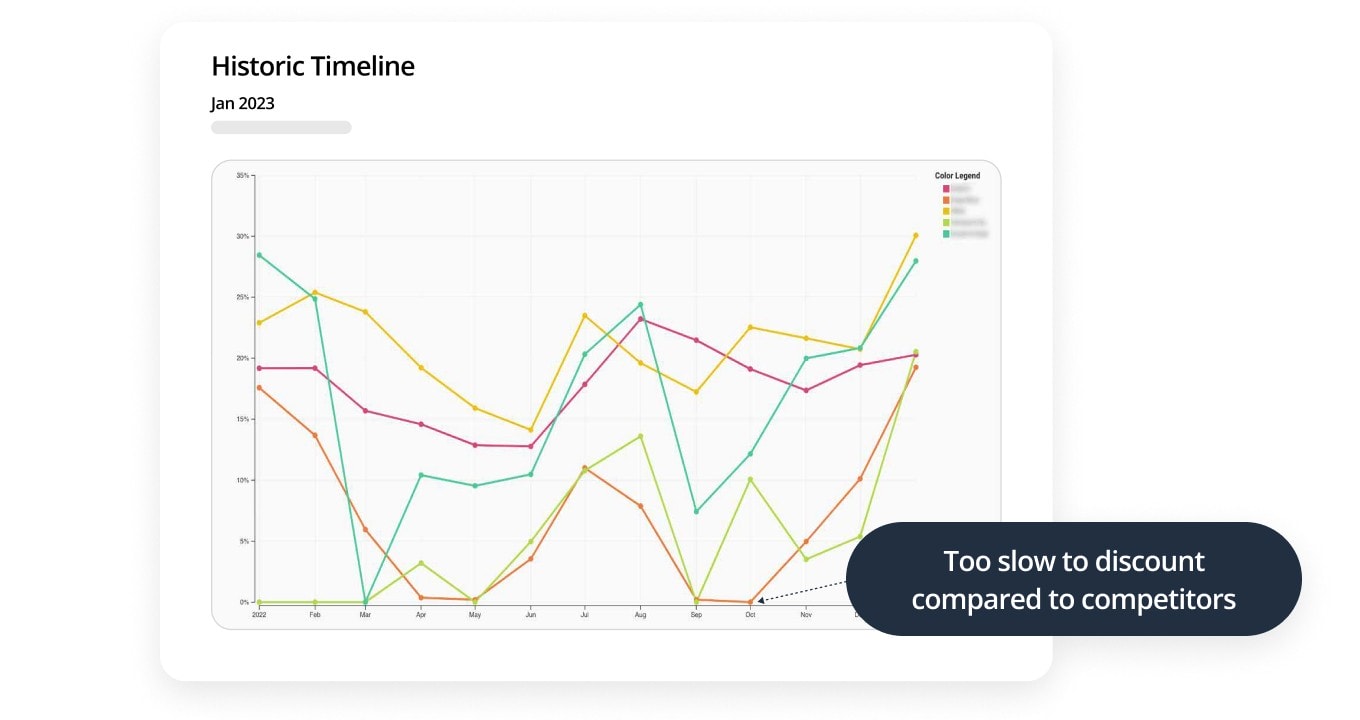

It’s not only important to see what is happening in real-time, but historical data needs to be easily accessible to provide insights into variables such as the time frames of price changes and ebb and flow of seasonal trends. It’s important to know if the trends you’re looking for are short lived or growing steadily. Proper price benchmarking gives teams the capability to reflect back and learn from both internal and external past price activity, such as when prices rose or fell, when popular products sold out or when discounts occurred, to make more sound planning for the future.

What are the Benefits of Competitive Price Benchmarking and Monitoring Software?

Pricing decisions are some of the most critical any retailer will make. As manual tracking can be contaminated with skewed data that either looks at only a small percentage of a collection, a handful of competitors or data that is already out of date. However, an effective competitive price benchmarking and monitoring software can provide a more comprehensive, accurate and timely assessment of the current market landscape. Centric Market Intelligence combines these features in a visually-dynamic, easily-accessible format that’s light years ahead of the disjointed spreadsheets companies have relied on in the past.

It’s important to know when and how much to change pricing. These actions should take into account what competitors are doing. If the dresses category is not selling as well as you thought, and sales are dipping below the weekly targets, you can then look to see what competitors are doing. Are they discounting dresses as a whole category, or specific colors, styles or sizes? And if so, by how much? This is indication that it may be time for your brand to discount too and avoid ending up with excess inventory.

Discounting at the wrong time can lead to missed sales if you’re discounting later than competitors, or money left on the table if you’re too early. A well-timed discounting strategy is only possible if you’re keeping track of your competitors with a comprehensive competitor price tracking tool. By having visibility into which of their products are being promoted, when and at what percent gives insight into their discounting strategy so you can better predict timings and be on the leading edge of the promotional cycle.

Buyers, planners and merchandisers must be in the loop with new and emerging trends when designing and planning future assortments. By using an effective pricing tool, teams can gather insights into industry trends to better understand what consumers are looking for and what parts of their inventory competitors are investing in.

New launches are also key to continuous brand evolution and growth, but entering a new category can be daunting. Using Centric Market Intelligence, allows teams to truly understand the landscape they are entering from the price points of other players in that region to the products on offer, the subtle differences and the nuances to different regions.

Three Signs it’s Time to Switch to a Price Monitoring and Benchmarking Tool

Is a competitor price monitoring software a needed part of your company’s competitor pricing strategy? One way to tell is by assessing if your current system is working and properly informing your pricing strategy. Have any of these revenue-impacting issues occurred?

- Pieces were priced too high and consumers opted for similar less expensive options with competitors

- You missed the emergence of a trend with competitors capitalizing on the opportunity

- Discounting happened too late and resulted in excess inventory

Even if you’ve never experienced a pricing crisis such as these, that doesn’t mean that your revenue hasn’t suffered from a pricing misstep, you might be promoting in the dark not realizing you’re cutting prices beyond what you need to. Missed opportunities to discount or raise prices are often never revealed until the right price monitoring and benchmarking software is adopted.

The Right Competitor Price Monitoring Software is Priceless

Finding the proper balance of competitor pricing analysis and internal metric collection is key to a healthy pricing strategy. For ecommerce retailers, it’s important to continue to place resources into maintaining a quality shopping environment, one which adds value to the customer experience. Price tracking, which is both accurate and timely, is central to effective product positioning and can bolster sales and prevent excess inventory in a cost-effective and time-efficient manner.

Whether it’s product range launch, adjusting prices for inflation or simply keeping up with the fierce competition within long-standing product categories, real-time pricing data that’s accessible and user-friendly, visually-based and highly accurate provides teams with the insights they need to remain a step ahead of competitors. Centric Market Intelligence is an AI-driven analytics, pricing intelligence and competitor benchmarking solution that will empower your teams to make more informed data-based decisions across pricing, discounting and assortment strategies.